EQUATE chief speaks to POLYMERUPDATE on expansion, strategy, shale gas – A Report

|

During the event, Husain addressed a select press meet that included representatives from ICIS, Platts and Chemical Week. Neeraj Rawal represented

POLYMERUPDATE at the meet. Husain began by speaking about the history of the petrochemical industry in Kuwait that began in 1963 with the formation of Petrochemical Industries Company (PIC). The industry was further boosted in 1995 by the formation of EQUATE which is currently a joint venture between PIC, The Dow Chemical Company (Dow), Boubyan Petrochemical Company (BPC) and Qurain Petrochemical Industries Company (QPIC), and the subsequent commencement of operations in 1997. Husain enlisted the inception of EQUATE as a major step in the history of the Kuwaiti petrochemical industry. With the commencement of the entire Greater EQUATE in 2009, the petrochemical capacity of the country was almost doubled and the challenge was to continue the sustained growth achieved by the company in the past, Husain added.

Replying to questions on the future expansion plans of EQUATE, Husain highlighted the company's "2020 strategy" that includes three main stages. He said that the first stage is all about creating as much value addition from current facilities via projects such as debottlenecking the existing facilities, which is underway. The second and third phases are about making EQUATE have greater global presence, with all stages focusing on distinguished human resources, especially Kuwaitis, through being more specialized and optimum technology utilization within a creative, innovative and sustainable work environment.

Neeraj Rawal then raised the issue of the shale gas revolution in the US and it became a key topic of discussion at the event. Husain said that shale deposits are abundant in North America but are scarce elsewhere such as in Europe and India. China is still exploring its shale gas potential and is faced with difficulties involved in the extraction of shale gas. Thus, he believes that how the shale gas boom is going to impact the future of the petrochemical industry depends on whether the US will use its shale gas locally within its borders or export it to other nations. In the scenario that the US decides to export its shale gas as an energy source, the petrochemical industries in the Gulf will not stand to benefit from the shale gas boom. In the event that the US decides to use its shale gas internally, market share will play a major role. In that case, EQUATE sees it as an opportunity to be a part of the excitement surrounding the shale gas revolution and generate good value addition for Kuwait. Also, considering that EQUATE has the US-based Dow as one of its shareholders, Husain believes that EQUATE has an edge over other petrochemical companies in the Gulf to benefit from the US shale gas boom. As of now, EQUATE is focusing on the projects that it has in hand, such as debottlenecking and globalization.

When queried on competition by other petrochemical companies in the Gulf, Husain said that it has always been a difficult market and has always been highly competitive. He added that although EQUATE does not have a large scale like other companies in the Gulf, it has created an identity through its commitment to providing the best possible products and services to its customers.

When asked to comment on on-going expansion projects by EQUATE, Husain said that the company is in the process of acquiring more feed (ethylene) and most of it will be used for polyethylene (PE) production. The company is also considering procuring feedstock from outside Kuwait in case there is a shortage of raw material in the country, thus moving towards its goal of becoming a global company that operates multiple facilities all over the world. Husain nonetheless added that he is quite optimistic about gas reserves and production in Kuwait.

At this point, Mr. Rawal inquired whether EQUATE would like to further tap into key Asian markets like India and China. Husain replied that India and China have demonstrated exemplary growth in the recent years and the economy in both countries is quite strong, and thus EQUATE and EMC would be happy to boost cooperation with the Asian countries.

Elaborating on the debottlenecking underway at EQUATE, Husain said that funds for the project have already been allocated and he expects production at the debottlenecked facilities to commence during 2015. Regarding debottlenecking of its other products such as polypropylene (PP) and paraxylene (PX), Husain said that the company is currently only concentrating on the debottlenecking of PE facilities and that EQUATE does not own the PP and PX facilities but only operates them.

Mr. Rawal then raised the question of whether the converting/processing industry is expected to grow in the Middle East, to which Husain replied in the affirmative. He said that countries in the Gulf are faced with different kinds of challenges and noted issues relevant to stability in other countries like Egypt and Syria. Nevertheless, he believed that for Gulf countries to achieve growth, they might have to move in the direction of downstream processing and specialty products in the near future.

Refinery-petrochemical integration owing to the scarcity of feedstock was another issue that was raised in the meet and Husain was asked on those lines whether EQUATE plans to join hands with Kuwait Petroleum Corporation (KPC) which owns PIC. To this Husain responded that the company will not hesitate if a suitable opportunity arises, adding that in the scenario that EQUATE decides to partner with KPC, which has stakes inside and outside of Kuwait, the key fortes that EQUATE will bank upon are its operational excellence and commitment.

Responding to queries on the projections for EQUATE's main products, PE and monoethylene glycol (MEG), Eliezer Maldonado said that demand for PE and MEG are expected to grow by 4.5% and 6%, respectively, in the next three years. Husain added that the market for the products is expected to become tighter and there will be more PE and MEG capacity additions during 2017-2018. Regarding current operating rates at EQUATE facilities, Husain preferred not to give the exact figures but said that the facilities are operating at very high production rates.

END

For further information, commentary and interviews, please contact us on +(91-22) 61772000 and info@polymerupdate.com

ABOUT POLYMERUPDATE

POLYMERUPDATE is India's leading plastics and petrochemical intelligence provider. For over a decade

POLYMERUPDATE has been a world renowned provider of Petrochemical Market

Intelligence through real time news and price alerts with subscribers based in over 55 countries.

POLYMERUPDATE is the world's first to develop BlackBerry, Android, iPhone & iPad applications thereby achieving its goal of empowering every Smartphone owner with polymer market industry feeds while on the move.

Visit POLYMERUPDATE on the internet at www.polymerupdate.com

About EQUATE

Established in 1995, EQUATE is an international joint venture between Petrochemical Industries Company (PIC),

The Dow Chemical Company (Dow),

Boubyan Petrochemical Company (BPC) and Qurain Petrochemical Industries Company (QPIC).

Commencing production in 1997, EQUATE is the single operator of a fully integrated world-scale manufacturing facility producing over 5 million tons annually of high-quality petrochemical products which are marketed throughout the Middle East, Asia, Africa and Europe.

Sign up for our newsletters

More like this

Does India really stand to benefit from the US shale gas boom Read More

Iran's prospects: post Geneva accord Read More

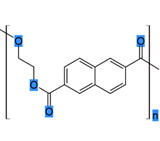

Polyethylene Naphthalate — A new-generation, high-performance polymer – Lekhraj Ghai Read More

The European Debt Crisis - What transpired and what can be expected — by Lekhraj Ghai Read More

Importance of PVC in Indian Petrochemical Industry — by Lekhraj Ghai Read More