Surge in American oil production – A problem of plenty for USA;

a major challenge for others

Shale gas being drilled in the USA

(Photo credit: World Tribune.com)

The unforeseen oil boom in the US has gradually started causing concerns while benefitting the US economically and the US is now producing more oil than it is importing for the first time since the 1990s. Recent figures suggest that the US is producing more crude oil than it has in 25 years, and the government predicts that production will approach its 1970 peak of 9.6 million barrels per day in 2016, making it the world's largest oil producer. Nevertheless, the US imports around 7.5 million barrels per day but its domestic oil consumption has declined over the years.

In 2011, people were skeptical even when US President Barrack Obama said that the US would reduce its crude imports by one-third by 2025. It took just three years for Obama's predictions to become true; the oil market has undergone a sudden major transformation, jolting the world. Today the US is faced with the dilemma of whether to export the domestically produced oil or to stick with the nation's 39-year-old ban on the exports of unprocessed crude oil. An aftermath of the 1973 Arab oil embargo, the Energy Policy and Conservation Act was put in place in 1975 to ban the exports of crude oil from the country in order to protect US consumers from volatility and price spikes. The Act allowed crude exports under select circumstances, and over the years the US has permitted exports from Alaska's Cook Inlet and certain heavy oil fields in California as well as small exports of crude oil to the neighboring countries of Canada and Mexico. Crude oil that is transported via the Trans-Alaskan Pipeline and re-exports of oil imported from other countries are also exempted from the ban. The ban also does not cover the exports of refined oil and domestic refiners continue to make profits by buying cheaper US crude oil and selling the refined products like gasoline in the US and abroad.

|

alleviation of the threat of earthquakes in the seismically active areas of the US and the large quantity of rocks that are left behind following shale oil drilling. France in 2011 became the first nation to ban fracking and some other countries have placed a temporary moratorium on the technology. A few US states such as New York also have a moratorium in place on hydraulic fracturing. Nevertheless, the oil industry in the US insists that fracking does not harm the environment and has continued to employ fracking for recovering crude oil, despite its high costs. According to the National Petroleum Council, an American advisory committee representing oil and natural gas industry views to the United States Secretary of Energy, a ban on fracking in the US could result in a loss of 45 percent of domestic natural gas production and 17 percent of crude oil production within five years.

|

from Venezuela, Saudi Arabia and Canada. The lack of pipelines and the high expenses involved in shipping by water make transportation to the US East Coast difficult, where refineries are equipped to handle the lighter variety of crude oil.

This has led to an artificial depression in the prices of unrefined crude oil in the US and some US refiners have reaped huge benefits by buying cheaper US crude oil and selling it as refined fuels, often abroad. According to Energy Information Administration (EIA), US exports of gasoline and other refined products amounted to 2.6 million barrels per day in 2012, which is more than twice of that exported in 2007, making it the second largest gross exporter of gasoline and diesel in the world.

Major US refining companies such as Valero Energy are in favor of the ban and advocate that US refiners would run into losses if the ban is lifted, causing them to produce less and invest less in the country, which would ultimately lead to a loss in US jobs. Concerns that if the ban is lifted it could lead to a rise in prices of US gasoline and result in decreased energy security have ensured that the ban has stayed in place over the years. Environmental groups have also raised concerns that lifting the oil ban could lead to more drilling, which in turn would lead to more elaborate and more environmentally damaging techniques such as fracking and an increase in overall greenhouse-gas emissions. Furthermore, there are arguments such as the one made by New Jersey Senator Robert Menendez that "Crude oil that is produced in the US should be used to lower prices here at home, not sent to the other side of the world."

On the other hand, major US oil producers such as ExxonMobil and ConocoPhillips are opposed to the restrictions on exports and are calling for an end to the ban. The US oil producers lobby is calling on the Congress and Obama administration's Commerce Department to allow oil exports as it believes that the light and sweet crude that is in surplus in the US is highly coveted by foreign refiners and exporting the same would help reduce the oil glut. Contradicting arguments have been put forward by economists and analysts that allowing exports would have little or no effect on prices and could actually improve energy security by encouraging more domestic production. Easing the restrictions would mean major policy changes, which would be politically difficult for Obama, particularly in an election year. However, the Congress is expected to rewrite the four-decade-old ban to reflect 21st century conditions as there are reports that the American Petroleum Institute would prefer a more permanent legislative solution rather than temporary adjustments by the Commerce Department.

In the more likely scenario that the export ban is lifted, industry executives predict that oil exports from the US could cross the 500,000 bpd mark by 2017, which would be just about 5 percent of the 9.6 million bpd it is expected to produce by then, but would raise several billion dollars a year for the country.

Outcome of the "Oil Boom

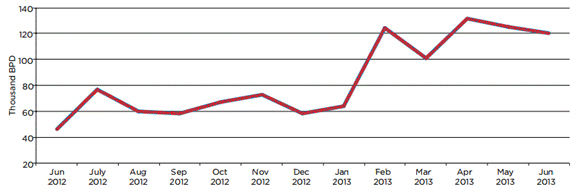

US crude oil exports from June 2012 to June 2013 (Source: EIA)

Meanwhile, the oil boom in the US continues to hurt the refinery and chemicals business in Europe and threaten the economies of Gulf Cooperation Council (GCC) countries as well as those in West Africa and South America that rely heavily on the exports of crude oil. According to International Energy Agency (IEA), fifteen European refineries have been forced to shut up shop in the past five years as they could not compete with the cheaper refined products exported from the US. The past few years have also seen a fall in the exports of Nigerian crude oil and the US is expected to soon reduce imports of oil from South American countries like Venezuela and GCC countries like Saudi Arabia.

Europe's woes meanwhile continue, as the US, once a crude importer from the region, has transformed into becoming one of its major oil suppliers. The American Chemistry Council (ACC), an industry trade association that represents chemical companies as well as the plastics and chlorine industries in the US, estimates that the chemicals industry in the US will be 21 percent larger than that in Europe by 2020, as Europe continues to wage a losing battle versus lower-cost competitors from the US. Moreover, Europe is still to recover from the financial crisis that has engulfed the region since the late 2000s. In order to catch up with the US, European countries have no choice but to relax their rigid policies, particularly regarding fracking and shale gas exploration in the region. According to latest reports, French oil major Total has announced an investment of around USD 50 million for shale gas exploration in the East Midlands region in the UK. Britain's chemicals industry has also been pushing the government to clear obstacles in shale gas drilling to support the country's USD 33 billion chemicals industry that has started to stagger due to the low-cost competition from the US.

The outlook for GCC countries that rely heavily on their crude exports also seems bleak this year. Major oil exporters from the Organization of the Petroleum Exporting Countries (OPEC) such as Saudi Arabia have continuously downplayed the threat from the US shale gas boom and OPEC left its production ceiling unchanged at 30 million bpd, despite prospects of addition in the output from countries like Iraq, Iran and Libya, in an attempt to keep crude prices in check. Saudi Arabia's Oil Minister Ali al-Naimi recently said that the kingdom is not contemplating cutting back on production as it believes that the oil market is balanced as of now. Despite such assurances, market pundits believe that OPEC countries will have to reduce their dependence on crude oil exports as they are faced with challenges from the US oil boom as well as the rising output within the cartel. The near future could see the US replace OPEC as the major exporter of crude oil and refined products to the energy-hungry Asian countries like China and India and such a scenario could force OPEC to cut its output in order to prevent a worldwide glut.

END

For further information, commentary and interviews, please contact us on +(91-22) 61772000 and info@polymerupdate.com

ABOUT POLYMERUPDATE

POLYMERUPDATE is India's leading plastics and petrochemical intelligence provider. For over a decade POLYMERUPDATE has been a world renowned provider of Petrochemical Market

Intelligence through real time news and price alerts with subscribers based in over 55 countries.

POLYMERUPDATE is the world's first to develop BlackBerry, Android, iPhone & iPad applications thereby achieving its goal of empowering every Smartphone owner with polymer market industry feeds while on the move.

Visit POLYMERUPDATE on the internet at www.polymerupdate.com

Sign up for our newsletters

More like this

What went wrong with the manufacturing sector in China Read More

POLYMERUPDATE speaks with Borouge CEO Read More

POLYMERUPDATE and Platts showcase their joint product for South Asia at Plastivision 2013 Read More

OPaL Marketing Head speaks to POLYMERUPDATE at Plastivision 2013 Read More

EQUATE chief speaks to POLYMERUPDATE on expansion, strategy, shale gas – A Report Read More