Troubled Iraq rattles oil markets, threatens economies – A Polymerupdate Special Report

With Iraq on the brink of a civil war as the militants of the Islamic State in Iraq and Syria (ISIS) and their allies advance towards Baghdad, crude oil prices have flared up with Brent crude approaching USD 115/barrel late last week. The spike in crude oil prices has caused concerns for the oil market, especially as the Organization of the Petroleum Exporting Countries (OPEC) kept its oil output ceiling unchanged at 30 million barrels per day (bpd) in a recently concluded meeting in Vienna, Austria.

|

which may be used to launch airstrikes. Meanwhile, the key Iraqi cities of Tikrit and Mosul are still under the control of the insurgents even as clashes between the insurgents and Iraqi forces take place in other parts of the country.

How important is Iraq in the global oil scenario?

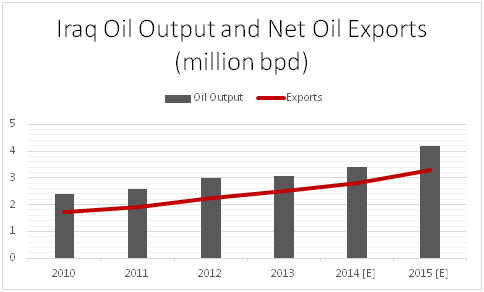

Iraq has 143.1 billion barrels of proven oil reserves, the fourth largest in the world. Furthermore, its southwestern desert territory, which has not been fully explored, is estimated to hold an additional 100 billion barrels of oil. Iraq is one of the founding members of the Organization of the Petroleum Exporting Countries (OPEC) and is the second largest oil producer within the cartel. Currently, Iraqi oil production stands at approximately 3.3 million barrels per day (bpd), which the country aims to increase to about 12 million bpd by 2020. It is widely believed that Iraq is capable of reaching an oil production target of 6.5 million bpd by 2015 despite the challenges it faces. Iraq also plays a very important role in plugging the deficit caused by the loss of about 1 million bpd of oil from OPEC member Libya. OPEC supplies have also been impacted by the western sanctions on Iran, and Iraq along with Angola have helped the OPEC offset the reductions.

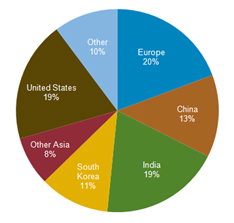

Iraq's Basra and Kirkuk blends are relatively sweet and light and are considered as high-grade oils. Along with the Unites States, India is the largest procurer of crude oil from Iraq. A large chunk of Iraq's crude exports go to Europe, where a number of refineries are configured to process light and sweet crude.

Iraq Oil Exports

Source: Lloyd List Intelligence quoted in EIA, Iraq Country Analysis Brief (April 2, 2013)

Consequences of the conflict

Crude oil exports from Iraq went down by 10 percent in March 2014 after militants sabotaged the 1.65 million bpd Kirkuk–Ceyhan pipeline that transports just about 300,000 bpd of oil from the north of Iraq to Turkey. Subsequent continued attacks on the pipeline have made repair work and maintenance difficult. However, the loss of the 300,000 bpd of oil from the north has not really made a dent in Iraq's export earnings. It is the south eastern part of the country, which holds about 80 percent of the country's oil reserves and from which 2.6 to 2.7 million bpd of oil is exported, that is important in the current scheme of things. Ahead of last week's OPEC meet, Abdul-Karim al-Luaibi, the Iraqi oil minister, said that the violence in the north is unlikely to spread to the south, adding that the south of Iraq is a very safe area. The Minister also said that the repair work on the sabotaged Kirkuk–Ceyhan pipeline is underway but if the need arises, oil from the north could be brought to the south and then exported from the Al-Basrah Oil Terminal (ABOT). He also clarified that the country's biggest refinery at Baijii in the north remains under government control.

Nevertheless, the worst-case scenario that the south of Iraq is lost to the militants could translate into a loss of 2.6 to 2.7 million bpd of oil supply, a void that could be difficult to fill for several months.

The ongoing crisis in Iraq also seems to have a highly disruptive impact on Indian stock markets, with the BSE Sensex falling by 348 points or 1.36 percent and the Nifty falling by 107 points or 1.41 percent on Friday with oil companies HPCL, BPCL and Indian Oil among the biggest losers. The soaring oil prices have also adversely impacted the Indian rupee. The rupee weakened by 51 paise to 59.77/USD, its biggest fall in nearly four-and-a-half months. Prices of gold also rose to a two-week high in the global market. Considering that crude oil is India's biggest import and Iraq is a key exporter of crude oil to India, the ongoing crisis and the surging prices of crude oil could lead to higher inflation in the country and endanger its economic revival, even as it is faced with the prospect of inadequate monsoon rains.

Who will fill in for Iraq?

In the event that the south of Iraq is annexed by the militants and supplies form the country are halted, oil prices could rise by another USD 15 to USD 20, a situation that could derail the global economic recovery. In such a scenario, it will be extremely crucial to offset the loss of oil supply from Iraq. Saudi Arabia, Kuwait and UAE, the other OPEC members which have spare capacity, could step in to fill the void. However, it should be noted that power consumption in the Middle Eastern countries escalates during the summer and they consume a considerable amount of the domestically produced crude oil for power production in order to meet the escalated demand for power supply.

Outside the cartel, the shale-rich USA, with a projected doubling of its capacity in the next few years, seems to be one country that is sufficiently equipped to deal with this crisis. The United States is producing more crude oil than it has in 25 years, and the government predicts that production will approach its 1970 peak of 9.6 million barrels per day in 2016, making it the world's largest oil producer. However, there is an export ban in place in the USA, which disallows the exports of crude oil from the country in order to protect US consumers from volatility and price spikes.

It remains to be seen thus whether the crisis escalates and if the supply is disrupted, will the OPEC be able to find a solution within the cartel or does a non-OPEC country contribute towards offsetting the deficit in oil supply.

END

For further information, commentary and interviews, please contact us on +(91-22) 61772000 and info@polymerupdate.com

ABOUT POLYMERUPDATE

POLYMERUPDATE is a news and media portal headquartered in India that specializes in providing daily market-moving information and pricing data on petrochemical products and industrial polymers from key markets in Asia, Europe, Middle East and the United States. The portal also hosts weekly and

monthly scans on commonly used polymers and analysis reports based on import data in India in addition to the Polymerupdate/Platts Joint Reports on PE, PP and PVC. Polymerupdate mobile apps are currently available on iPhone and iPad, and BlackBerry and Android platforms. Polymerupdate also provides news alerts on the move through its SMS and instant messaging services. In addition, Polymerupdate publishes interviews and articles, which are a rich source of information on the latest trends in the chemical and petrochemical industry.

Visit POLYMERUPDATE on the internet at www.polymerupdate.com

Sign up for our newsletters

More like this

An interview with GPCA's Dr. Abdulwahab Al-Sadoun Read More

Complementing Growth of Plastics Manufacturing in India: An Interview with UNIDO ICAMT Read More

Huntsman speaks with Polymerupdate on its Polyurethanes Business and its Contributions to the Indian Plastics Industry Read More

ONGC Chairman Sudhir Vasudeva inaugurates Oil & Gas World Expo 2014 – A Polymerupdate Report Read More

PIF launches Plastindia 2015 amid much fanfare Read More